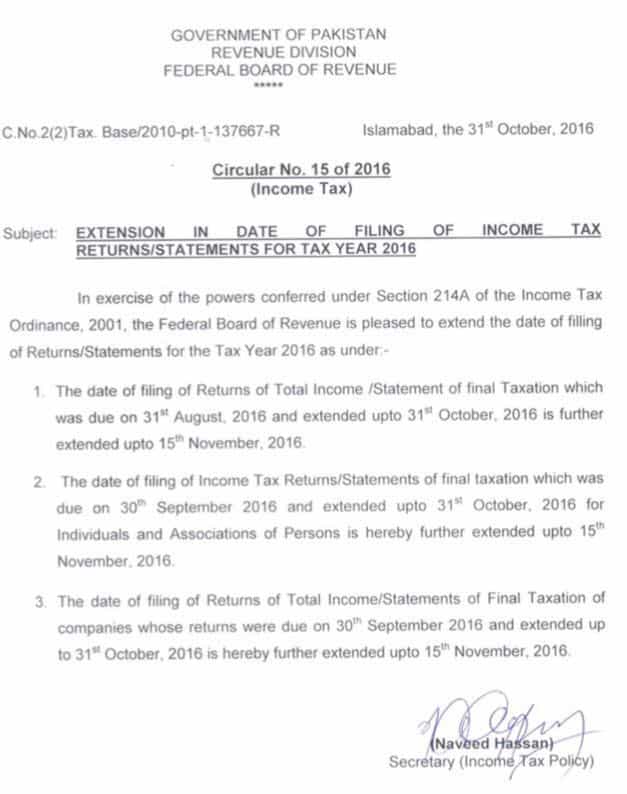

According to a new notification by FBR, the deadline for Income Tax Returns has been extended by a span of 15 days. Thus, the last date to submit all income tax returns is now 30th November 2016. The new deadline applies on final tax regime, business individuals, association of persons, salaried individuals, and companies falling under special tax year.

Originally the last date was August 31st. This was moved to September 30th and recently to October 31st, however because tax payers did not comply with the given dates, it has now been extended, which is now a usual practice y FBR.