In Pakistan, where cash reigns supreme, easypaisa has become a ray of hope for financial inclusion. When this branch-less banking service was first introduced in 2009, millions of people were promised ease, accessibility, and empowerment. Has it, however, actually fulfilled its potential? Let’s examine easypaisa’s history, from its founding to the present, and hear the tales of disgruntled users who encountered unforeseen difficulties.

Initial Years And Current State Of easypaisa In Pakistan

easypaisa’s mission was simple: to provide basic financial services to the unbanked population. With a focus on mobile money transfers, bill payments, and utility services, easypaisa aimed to bridge the gap between traditional banking and the masses.

In the present day, easypaisa has an astounding 9 million active monthly users. Due to the increase in both its value and transaction volume, it has become a major participant in Pakistan’s digital payment market. But expansion has its own set of difficulties, and easypaisa has not been exempt from criticism.

A Glimpse Into Reality: Customer Stories

Social media has been blowing up with the appalling service easypaisa has to offer to its customers. Here are just a couple of examples found on social media:

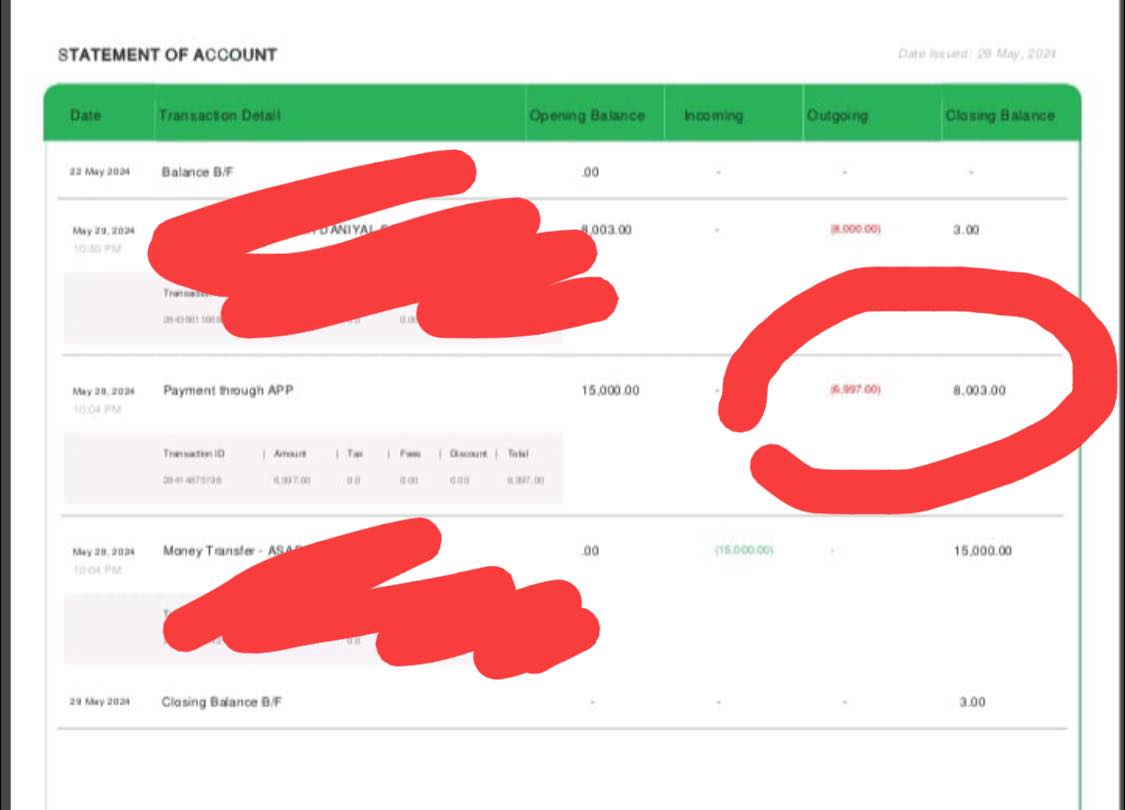

- Missing Funds: One user recently brought to attention a weird issue which has left people confused. He claimed to have received an amount of 15,000 PKR recently and for some reason he notices a random transaction of 7,000 PKR. It appears the amount mysteriously vanished from his account. To make matters worse; there is no receiver’s information available for the transaction! Many users were able to relate to the incident and had comments about the abysmal performance of customer service.

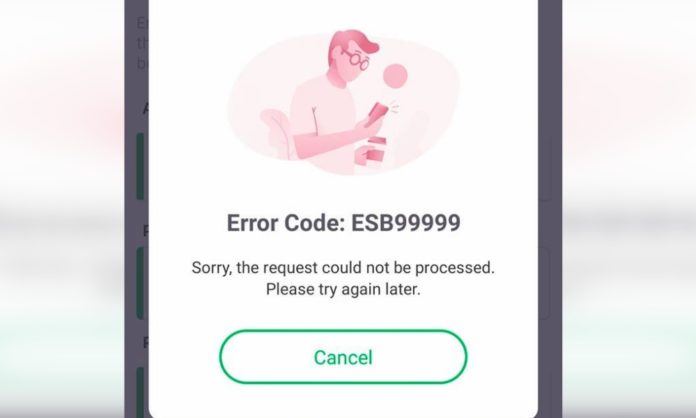

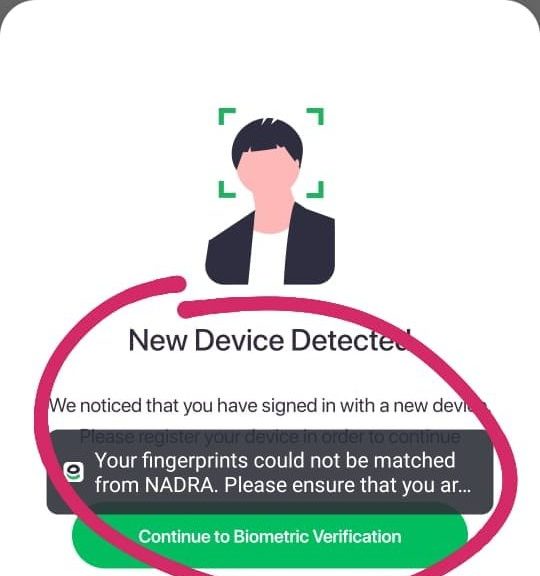

Image Source: Facebook - Fingerprint Verification Gone Wrong: easypaisa uses bio-metric fingerprint verification to ensure customers safety. A user reported verifying his fingerprints via the app. But after resetting his phone, he has been unable to login to his account with the error stating “Your fingerprints could not be matched from NADRA”. The frustrated user has reached out time and time again to easypaisa to resolve his issue, but none of them have been able to help him, resulting in him being locked out of his own account.

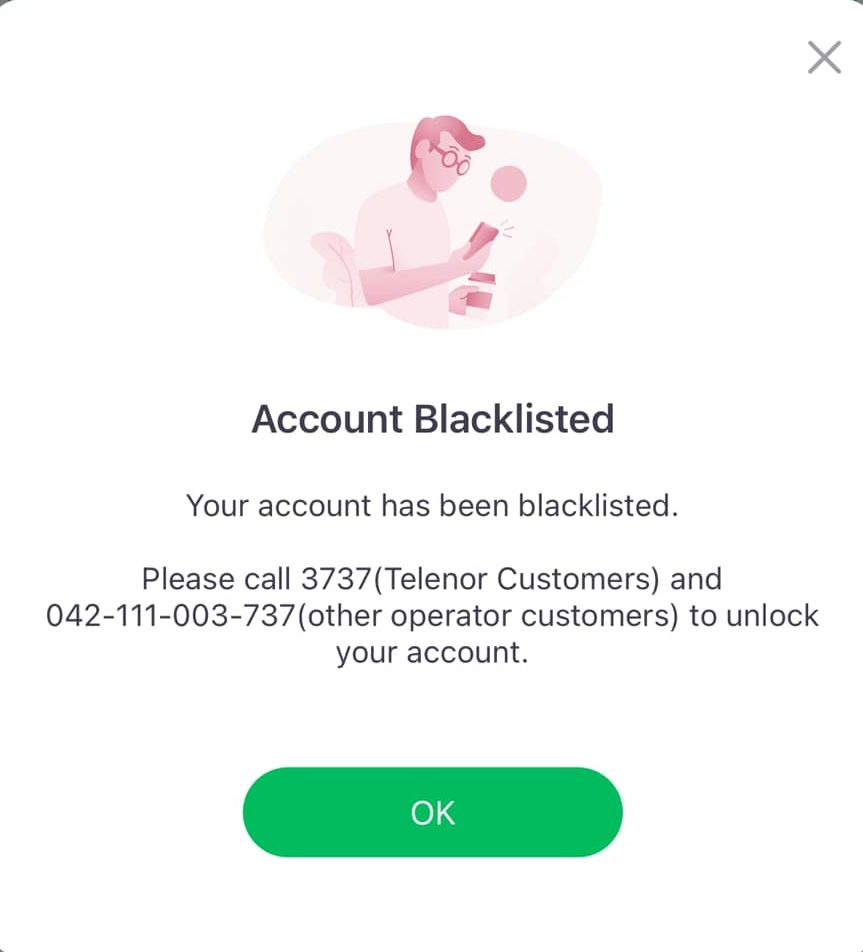

Image Source: Facebook - Blacklisting Accounts: easypaisa has become a hub for unresolved complaints, specially in the past couple of years. Users have expressed frustration due to being blocked without any specific reason. Another user, who has been unable to access their account for the past month, shared their story. The user claims that both their JazzCash and easypaisa accounts have been suspended, yet none of the representatives have provided proper reasoning or resolved their issues. The best reason they provided so far regarding the blocked account was due to “Disputed Transaction” which has ultimately left the user distressed.

Image Source: Facebook

The Future Of easypaisa

As Pakistan hurtles toward a digital future, easypaisa stands at a crossroads. Will it continue to be a lifeline for the unbanked, or will it succumb to the challenges of growth and security? Only time will tell.

easypaisa, once a beacon of hope, now grapples with its own demons. As we navigate this digital landscape, let’s demand accountability, transparency, and customer-oriented solutions. After all, financial empowerment should never come at the cost of trust.

Stay tuned for more tech reports like these; this is your favorite, friendly neighborhood techie, Zayaan, Signing Off!