The Pakistani Finance Minister, Muhammad Aurangzeb, presented the budget for FY26 on Tuesday in the National Assembly. Under IMF rules and regulations, the government targets a 4.2% economic growth in the coming year.

The newly presented budget saw a 6.9% drop from the FY 2024-25 budget, with a total sum of 17.573 trillion. This time, the government has promised relief for the common man and greater developmental spending.

Salaried Class and Government Employees Among the Biggest Benefactors

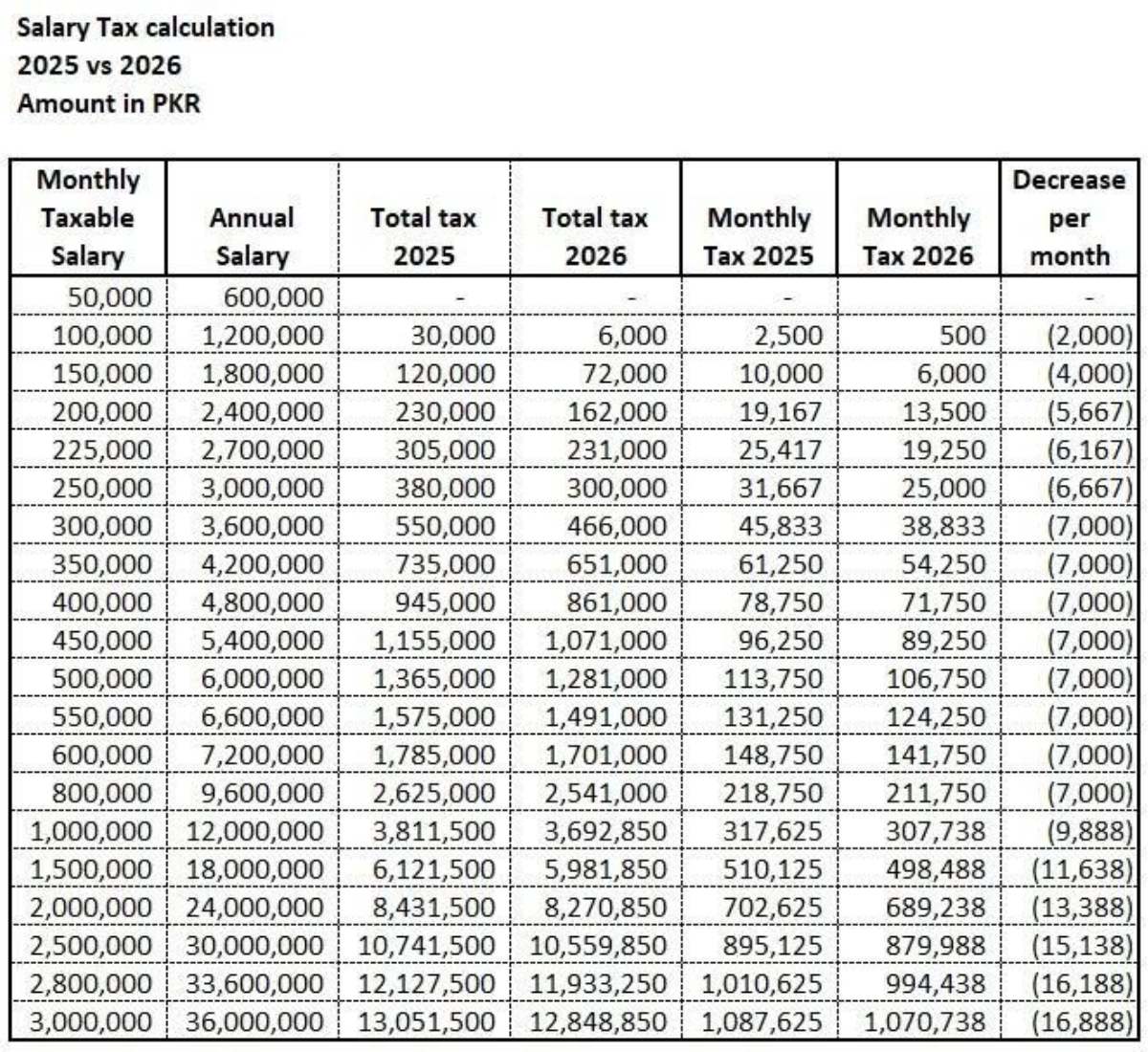

In accordance with its promise to provide relief, the federal budget for FY 26 aims to provide significant “income tax” relief to the salaried class across all income brackets.

Aurangzeb claimed that these concessions were to reduce the brain drain.

The federal government also proposed to increase the salaries of serving government employees from Grade 1 to Grade 22 by ten percent. Furthermore, a seven percent increase in the pension of government officers was also announced.

Significant adjustments were also announced for property and land taxation. Withholding tax on the purchase of property was reduced; the federal excise duty on the real estate sector was also cut.

The government took these measures to provide relief to the construction sector, which faced heavy taxation last year.

Relief for the Common Man?

While reductions in income tax and increases in salaries for government employees are solid concessions, the government may not have fulfilled its promise of providing relief to the common man.

Fuel prices are likely to increase with a 2.5 PKR/litre carbon levy on petrol and diesel. This will increase transportation costs for the common man and disproportionately impact industries reliant on energy and transport.

Cigarette prices are likely to increase too. In addition, movie ticket prices are also expected to see a surge, getting out of reach of the common man and reducing entertainment avenues. Frozen Food, cold drinks, biscuits, noodles, and ice cream are likely to become more expensive too.

One of the biggest blows saw an eighteen percent sales tax on the import of solar panels, increasing the cost of renewable energy for potential users. The urban middle class, looking to escape high electricity bills, are likely to suffer the most.

Experts continue to debate the degree of meaningful relief to the business community and the common man. In the words of Pakistan Business Council Chief Executive, Ehsan Malik, there is no concrete plan to broaden the tax base and spur industrialisation.

With rising costs of fuel and consumer items, the standard of living of the common people is likely to deteriorate.

Stay tuned to Brandsynario for the latest news and updates.