UBL has embraced the transformative potential of technology and envisions a future where banking is revolutionized. UBL has significantly invested in developing cutting-edge digital solutions, recognizing customers’ ever-changing needs in the digital era. UBL’s mission is to ensure accessibility, convenience, and security for all Pakistanis, irrespective of their geographical location or financial circumstances.

The Progressiveness Of Tomorrow: Award-Winning Digital Solutions

UBL continues to be recognized as the industry leader in Digital Banking. Asiamoney lauded UBL’s digital excellence for the third consecutive year by declaring it the ‘Best Bank for Digital Solutions’ in Pakistan for 2022. Alongside, Euromoney announced UBL as the “Market Leader of Digital Banking” in Pakistan, mainly based on its track record as the best in digital.

Mobile Banking: Banking on the Go

UBL’s mobile banking app is a digital solution that makes banking more accessible and convenient. This app allows customers to access their accounts, execute payments, and transfer funds directly from their smartphones, regardless of location. This means that finances can be managed on the go without physically visiting a bank branch. The following are some of the key features of the app:

- User-Friendly Navigation: The UBL Digital App has a clean and easy-to-use interface with a well-organized layout for easy navigation. The app offers swift access to key functionalities through the bottom navigation bar, including account information, transactions, bill payments, and more.

- Consistent Design Language: UBL Digital App follows a consistent design language throughout the app, which provides a seamless user experience. The app uses a minimalist design approach, through which users can avoid clutter and receive the most relevant information and features.

- Personalization: UBL Digital App empowers users to customize the app’s interface and experience to their liking. Users can choose from various themes and color schemes and benefit from personalized recommendations and insights based on transaction history and behavior. This high degree of personalization can foster a sense of engagement and helps users to improve their overall satisfaction with the app.

Urdu Language Support: Enhancing Accessibility and Exclusivity

UBL Digital App is available in Urdu language as well. Through this feature, users can switch seamlessly between English and Urdu language modes, making the app more accessible for Urdu-speaking customers. This language support helps the UBL Digital App feel more inclusive and accessible.

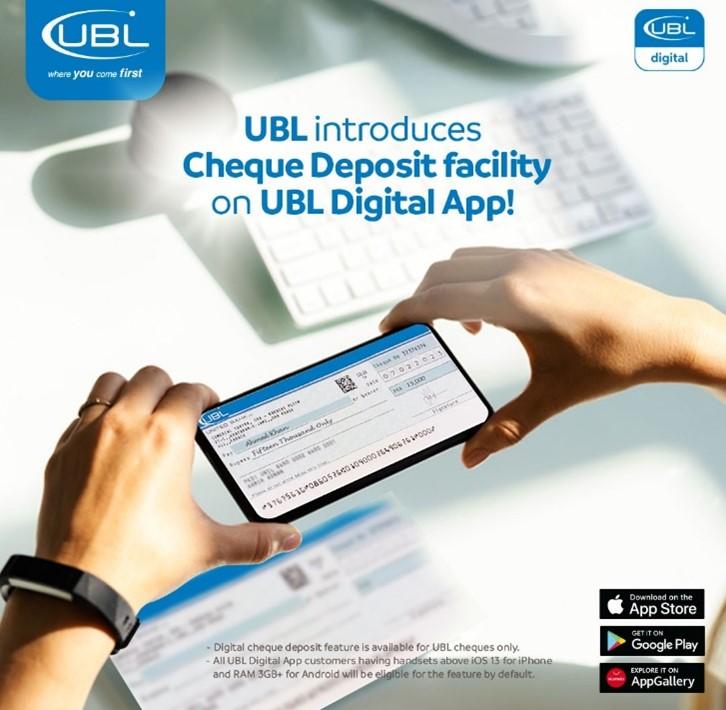

Digital Cheques: A Game-Changing Innovation

One of UBL Digital’s most significant digital innovations is the digital cheque. This technology allows customers to deposit their UBL to UBL cheques from the comfort of their own homes, without the need to visit a physical bank branch. This speeds up the cheque-clearing process and makes banking more convenient and accessible for customers.

Virtual Banking: Embracing the Metaverse

UBL Digital has also embraced the latest digital trends, such as the Metaverse, by launching its virtual presence within the popular platform. This allows its customers to engage with the brand in an immersive and interactive way, making banking more engaging and fun.

App Watch: Monitor and Manage Your App Usage

Another innovative solution they have developed is App Watch, a unique feature within the mobile app that allows customers to monitor and manage their app usage. With App Watch, customers can transfer funds, check their balance, and much more on the go. This means their customers can now manage their app usage, ensuring they always control their finances.

Aas Paas: Find Exclusive Discounts and Deals

The Aas Paas service allows customers to find exclusive discounts and deals at participating outlets, such as restaurants, clothing stores, and other retailers. Customers can access these discounts through the mobile app, making saving money while shopping or dining out easy. UBL Digital has partnered with a wide range of outlets across Pakistan to offer these discounts, making it easy for their customers to save money on everyday expenses.

UBL Pay: hassle-free way for users to make payments

UBL Pay offers a convenient and seamless way for users to make payments and perform other financial transactions from their mobile devices without needing physical cash or cards.

Savings and Investments: Manage Your Finances and Grow Your Wealth

UBL Digital App offers a range of savings and investment options designed to help customers manage their finances and grow their wealth. The mobile app offers a range of convenient and accessible options, including mutual funds and term deposits, allowing customers to earn higher returns on their savings.

UBL Asaan Digital Account: Simplifying Account Opening

UBL also offers a range of account options, including the UBL Asaan Digital Account, designed to make banking more accessible and convenient for everyone. The UBL Asaan Digital Account is a simplified account opening option that allows customers to open a basic account with minimal documentation and no fees or charges. This account is ideal for those needing access to traditional banking services or who prefer a more direct banking experience.

Auto Loan: Experience augmented reality like never before

UBL Digital App offers an augmented reality auto loan feature that allows users to visualize and explore different car models and features in a virtual 3D environment. It is a unique and immersive experience for users, making it easier for customers to visualize their dream car and explore different options before making a final decision. It also helps to simplify the car-buying process by providing users with financing information and estimated monthly payments in real time.

The Future Era Of Transformation

UBL is leading the way in digital banking innovation in Pakistan, offering cutting-edge digital solutions designed to make banking more accessible, convenient, and secure for everyone. UBL is proud to be at the center of the digital revolution and shape the future of digital banking in the industry.

These are just a few examples of the many innovative digital solutions that UBL has developed. They are proud to be at the forefront of digital banking in Pakistan. They are committed to advancing and evolving their digital services to meet the changing needs of their customers. To learn more about UBL and its digital banking solutions, please visit the website at www.ubl.digital.com, or follow them on their social media handles.

Stay tuned to Brandsynario for more news and updates.