Takaful (Islamic Insurance) is a relatively newer term, which is why people usually get confused about how it is different from conventional insurance or why should they opt for Takaful instead of insurance. Besides, a lot of people avoid insurance altogether because of its non-shariah compliant nature.

Every kind of insurance plays a vital role in today’s economy. We cannot ignore its significance in our businesses and lives. In our era, insurance joined hands with modern technologies, merging into a modern term of Insurtech, which is currently the worldwide adopted system. Muslim scholars and Ulamas, having full knowledge of Islamic systems, have developed a workable and successful takaful system compliant with all shariah rules, and many insurance companies in Muslim and non-Muslim countries have been operating with Islamic windows or limited offers for many years on these guidelines.

There are a few indicators which help understand if the model is genuinely a takaful model (as per Shariah). The most obvious one is the distribution of surplus, which is the hallmark of takaful. Takaful works on Waqf model which means there is a pool created from the amounts received from policyholders; if there is an excess amount left in waqf pool, that amount (or a part of it) should be returned to the policyholders. Another indicator is Shariah audit; all the processes of a takaful operator is audited by an independent body.

If we talk about fully dedicated, Shariah compliant organizations, with the most modern technology techniques, offering different solutions for every walk of life, there are only few names in the country, one of which is Salaam Takaful Limited. Salaam Takaful is the first Islamic Insurtech in Pakistan with a remarkable portfolio and dynamic objectives. They don’t just meet all the requirements for being a true takaful operator, but they also are a progressive organization. They have set new standards in the industry by taking many of such steps including digitization, creating a gender-balanced workplace, and so on. Salaam Takaful is the only operator with a diversified dedicated shariah board for implementation of the true elements of takaful in all its endeavors. Any new product or improvement in any existing product is discussed with this board before proceeding with the introduction to general audience.

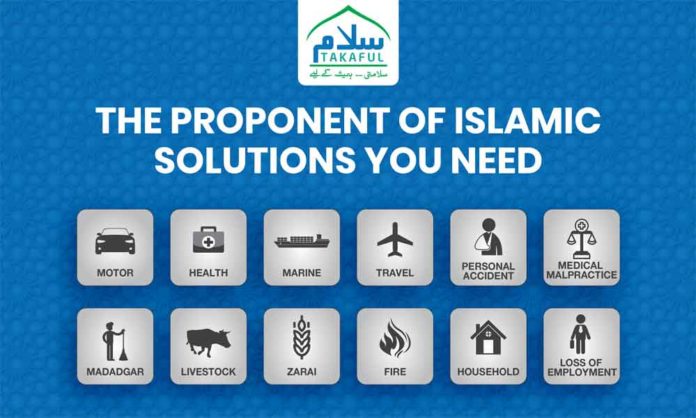

Salaam Takaful is the largest dedicated general takaful operator and first Islamic insurtech in Pakistan, with presence across the country. It has a comprehensively diversified product portfolio including, but not limited to, motor, health, travel, livestock, crop, fire, marine, etc. More information can be taken from www.salaamtakaful.com or online.salaamtakaful.com