On July 9, 2025, Nvidia set a record with a market capitalisation of $4 trillion. That is the first public company in history to reach this height. Although the valuation fell slightly by the close of the market, the moment was a historic triumph, marked by its leadership in AI.

Why $4 Trillion Matters

This achievement confirms Nvidia isn’t merely another technology behemoth. It broke all the rules. Apple and Microsoft are the only two companies to cross $3 trillion. However, Nvidia outperformed them in just two years, leveraging the AI wave.

The market now ranks Nvidia as one of the largest global brands, wealthier than all publicly listed companies in Mexico and Canada combined.

Investors threw cash at Nvidia for one reason: AI. Its chips drive almost all of the leading generative AI models. It is at the centre of demand in data centres. Its revenues surged 69% in Q1 to $44.1 billion. Profits did the same.

Most analysts now rate it as “buy,” and the average price target is $174 a share, higher than today’s approximately $164.

What Sets It Apart

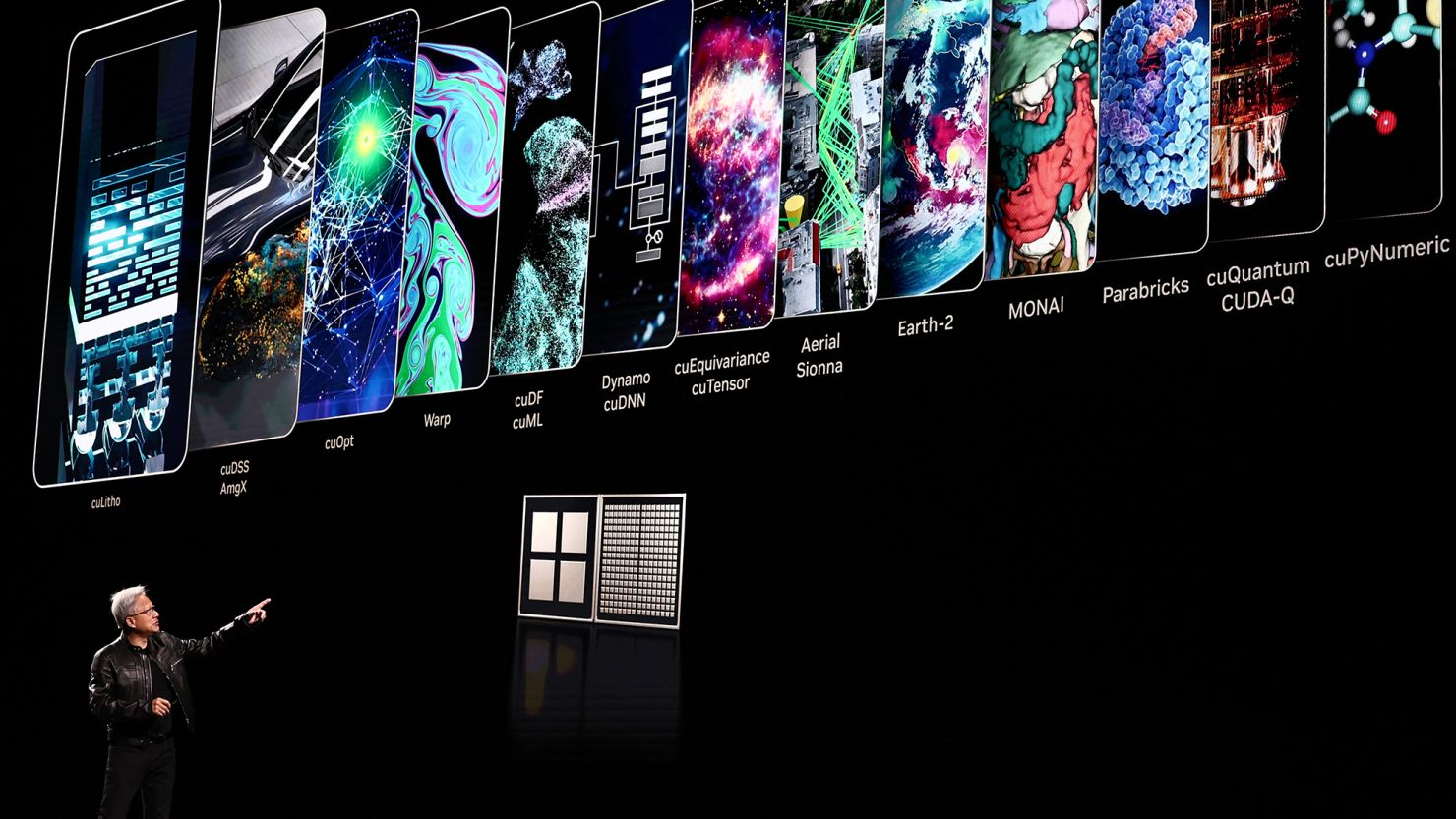

Nvidia evolved from a gaming GPU frontrunner into the pillar of AI computing. Its path from $1 trillion in mid-2023 to $2 trillion six months later and to $3 trillion earlier this year is unprecedented momentum.

In a little over two years, it grew to three times the size, in comparison to Apple and Microsoft’s more incremental ascents.

Markets welcomed the news. The S&P 500 reached record highs as Nvidia led the pack. However, experts have issued a warning about the risk of concentration. Nvidia alone now represents more than 7% of the index, surpassing Apple and Microsoft. A stumble in AI demand, chip regulation, or global trade could bring it crashing down.

So, What’s Next?

Expect Nvidia to reach even higher. Some forecasters project a $5–6 trillion market cap in 18 months, fueled by further AI growth. Rivals such as AMD and Intel can leap ahead, but Nvidia remains the reigning champion for the time being.

It will make significant deployments of Blackwell GPUs. It will enhance data-centre capabilities and accommodate additional AI workloads. Any export ban, particularly to China, can provoke violent market responses.

Nvidia didn’t just ride the AI wave; it shaped it. Reaching $4 trillion mark is a pivotal moment in tech history. This isn’t about gaming framerates, it’s about laying the foundation of tomorrow’s AI infrastructure. That said, no giant stays at the top forever.

Regulatory risks loom. AI competition intensifies. Yet Nvidia’s blend of innovation, execution, and timing remains unmatched.

Nvidia’s milestone marks a significant turning point. It transitions from tech darling to historical giant. The game is different now, and Nvidia is leading the way. Eyes now look to what is next: the path to $5 trillion, competition, and how this chipmaker could reshape tomorrow’s AI world.

Stay tuned to Brandsynario for latest news and updates