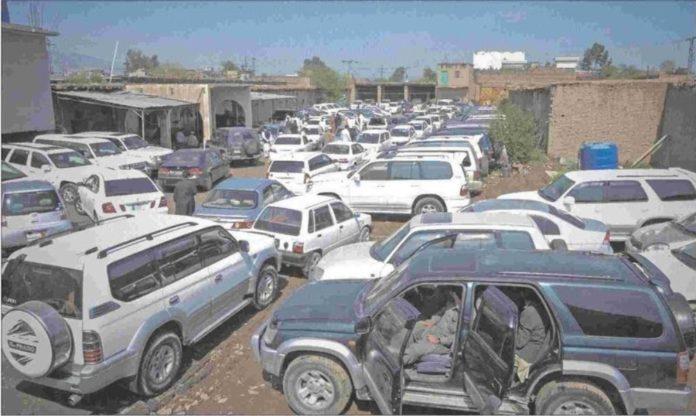

Pakistan’s Federal Board of Revenue (FBR) recently issued new Standard Operating Procedures (SOPs) for the clearance of smuggled and non-custom-paid vehicles in the country. These new procedures aim to streamline the clearance process and ensure that only genuine and legally imported vehicles are allowed on Pakistani roads.

Smuggling has long been a problem in Pakistan, with many vehicles being brought into the country without paying the appropriate taxes and duties. This not only deprives the government of much-needed revenue, but it also creates an uneven playing field for those who import and sell vehicles legally.

Vehicles will be subjected to thorough checks

Under the new SOPs, all vehicles brought into Pakistan will be subject to a thorough examination to verify their authenticity and ensure that all taxes and duties have been paid. This examination will be carried out by the relevant customs officials, who will also be responsible for issuing the necessary clearance certificates.

In addition to the examination, the new SOPs also require that all imported vehicles be registered with the relevant authorities within three months of their arrival in Pakistan. This registration process will involve the submission of a number of documents, including the vehicle’s original registration papers, proof of ownership, and proof of payment of all relevant taxes and duties.

Importers of non-custom-paid vehicles will also be required to pay the outstanding taxes and duties before their vehicles can be cleared. In cases where the original owner cannot be traced, the importer will be required to pay a fine equal to the value of the vehicle in addition to the outstanding taxes and duties.

The automotive industry is in support of the new regulations

The new SOPs have been welcomed by many in the automotive industry, who believe that they will help to level the playing field for those who import and sell vehicles legally. They also believe that the new procedures will help to reduce the number of smuggled vehicles on Pakistani roads, making them safer for all.

However, some have raised concerns that the new SOPs may also lead to an increase in the cost of imported vehicles, as importers may pass on the cost of the additional taxes and duties to the end consumer. Others have also questioned whether the relevant authorities have the capacity to effectively implement the new procedures, given the scale of the problem of smuggling in Pakistan.

Despite these concerns, the new SOPs represent an important step forward in the fight against smuggling and the promotion of legal trade in Pakistan. By ensuring that only genuine and legally imported vehicles are allowed on Pakistani roads, the new procedures will help to create a more level playing field for those in the automotive industry and improve the safety of Pakistani roads for all.

The new SOPs issued by Pakistan’s Federal Board of Revenue for smuggled and non-custom-paid vehicles are a positive development for the country’s automotive industry and the safety of its roads. By subjecting all imported vehicles to a thorough examination and ensuring that all taxes and duties have been paid, the new procedures will help to reduce the number of smuggled vehicles on Pakistani roads and create a more level playing field for legal importers and sellers. While there may be some concerns about the cost and implementation of the new procedures, they represent an important step forward in the fight against smuggling and the promotion of legal trade in Pakistan.

Stay tuned to Brandsynario for the latest news and updates.