A Memorandum of Understanding (MOU) was signed between Khushhali Microfinance Bank Limited (KMBL) and International Finance Corporation (IFC) for a transformation program that will extend over two years.

The essence of this project is to empower farmers through a digital-agri transformation program that will extend over two years. The project is being undertaken to empower farmers through digital agri-finance solutions and expand outreach to new rural microfinance customers in Pakistan.

The project will comprise a segmentation approach that will drive the Bank’s market strategy by delivering relevant product concepts. The project will leverage data from both Khushhali’s existing customer base & external sources.

IFC will help develop a digital solution for streamlining processes and nimble credit decisions. The project will also address with potential value change collaboration possibilities

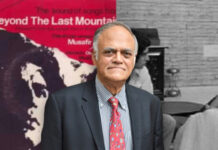

“It is truly exciting to be working with IFC to realize our joint goals of reaching the rural customers by leveraging digital technology and is part of our commitment to financial Inclusion”-by President Khushhali Microfinance Bank Ghalib Nishtar

“Projects like these help unlock new opportunities for the unserved rural population to access financial services while allowing the microfinance sector to adopt innovative technologies such as digital processing, value chain finance, and data analytics.

Partnering with KMBL, the market leader in Agri and rural lending, is a privilege for IFC where we can leverage our global experiences and expertise to create new markets enhance inclusion for underserved market segments and accelerate growth avenues for overall economic growth and job creation”-By Regional Manager – Advisory Services at IFC, Qamar Saleem.

IFC is a leading development finance institution and functions as part of the World Bank Group to spur private sector activity through investment and advisory across the Globe. IFC has played a leading role in supporting Agri-digital practices by collaborating with selected practitioners that can help towards the cause of financial inclusion.

Pakistan is a priority country for IFC. During the last three years, IFC has ramped up its investments and advisory services work in the country- with current investment commitments of USD 1.2 Billion, to support the development of Pakistan’s private sector.

The organization has focused on mobilizing investments in power and infrastructure and providing access to finance to micro, small and medium enterprises through financial intermediaries.