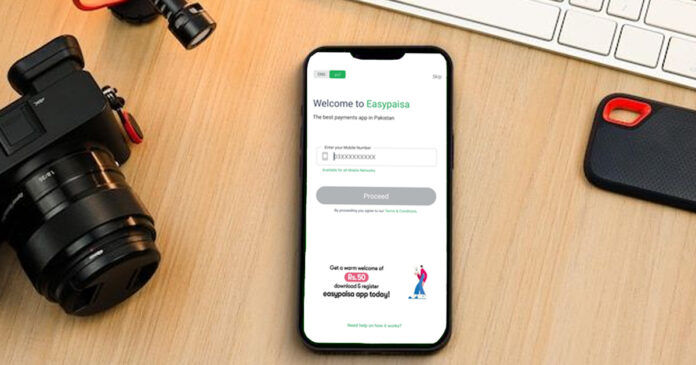

In today’s world, sending money has gotten as simple as sending a text. All thanks to the innovation of mobile wallets like Easypaisa. The features offered by this service provider have made handling finances much more convenient for the majority of Pakistanis.

Want to understand how to make Easypaisa account on mobile? Well, best believe you are in the right place.

How to Make Easypaisa Account – Easy Steps

Apart from sending money from an Easypaisa account, making the account itself is pretty simple too. There are two main ways you can make one:

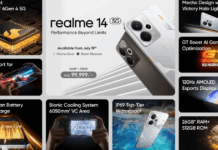

Using the Easypaisa App

The Easypaisa app is the most convenient way to register and manage your account.

- Download the mobile wallet app from the Google Play Store or App Store for iOS.

- Once the app is installed, register your account.

- Enter your mobile number in the space provided.

- Enter your Computerised National Identity Card (CNIC) number and the Date of Issuance for your CNIC. Your CNIC card can also be scanned.

- Select your city from the options provided.

- Enter a 5-digit Personal Identification Number (PIN) code in both the provided spaces to create your Easypaisa account

- Once the registration is complete, you will have complete access to the app and its array of services

| Important Note: The app is also available in Urdu for users who struggle to understand English. Moreover, please make sure that you memorise the PIN code to open the Easypaisa account at any time without any inconvenience. |

Using a Text Message

Don’t have access to the internet? No worries! You can still register using a simple SMS.

- Dial *786# from your phone.

- Follow the on-screen instructions.

- Set a secure PIN when prompted.

- Your account will be activated instantly.

- Alternatively, you can also visit any Telenor Franchise or Easypaisa retailer in Pakistan to open your account.

| Just a Heads Up: However, these instructions for opening an Easypaisa account with the app are only restricted to Telenor users. If you are not a Telenor user, then your account might open slightly differently. |

Opening an Easypaisa Account For Non-Telenor Users

If you are not a Telenor user, you can still create an Easypaisa account. The process might just be slightly long, but the steps are still pretty easy:

- Send a text message to 0345-1113737 with ‘EP<space>Your CNIC Number’.

- You will then get a call from an Easypaisa representative for verification.

- After verification, you will need to create a 5-digit PIN code when the call is redirected.

- Remember the PIN code, as you will need to send it in a text message once the call is over.

- Type ‘PIN<space>5-digit pin code<space>Confirm 5-digit pin code’ in a text message before sending it to 0345-1113737.

- Wait for a confirmation SMS from 3737 that will indicate that your Easypaisa account has now been successfully created.

| Important Point: Keep in mind to enter the PIN code you created in the previously mentioned message. |

How to Deposit Money into Your Easypaisa Account

Ok, now that the Easypaisa account is made, how does one carry out the monetary transactions with it? Well, it’s pretty basic. The account will first require a money deposit.

You can add money to your Easypaisa wallet in the following ways:

- Visit any of the Easypaisa shops in Pakistan.

- Perform a bank transfer from any bank account (select banks only).

- Receive funds from another Easypaisa user.

- Send money from another mobile account

- Transfer money through your CNIC number

- Perform a transfer through your RAAST ID

- Use your local or international Debit Card or Credit Card. Anyone with a local or international Visa/MasterCard Credit or Debit Card can top up their account.

- You can also use any of the available “Easypaisa Cashpoints” to use the deposited funds.

What is an Easypaisa Account?

An Easypaisa mobile account is an easy-to-use mobile wallet, available for all networks to access from their own mobile phones at any time. You can make all kinds of payments with your account. There’s no documentation required.

From the payment of utility bills to bank transfers and mobile top-ups, simple methods can allow you to perform a range of financial transactions. All you have to do is sign up with your CNIC and phone number.

People who might not have access to traditional banking services or think they are too much of a hassle, find alternatives like Easypaisa and Jazzcash pretty appealing. Learn how to make a Jazzcash account too.

Benefits of Easypaisa Account

There are plenty of benefits to having an Easypaisa account. Here are some key perks:

- Send and receive money instantly.

- Pay utility bills and buy mobile top-ups.

- Shop online with the Easypaisa debit card.

- Access microloans, insurance and savings (i.e short-term loans of PKR 10,000)

- Ease of international money transfers

- Top up of credit balance for prepaid SIMs of all networks

- Available 24/7, anytime, anywhere in Pakistan.

Important Tips for Easypaisa Account

You need to understand that Easypaisa is still a financial service. And like any other service, this mobile wallet also comes with its own important tips that must be kept in mind at all costs.

- Forgetting Easypaisa Pin: In case you forget your login PIN, you can request the ‘Forgot PIN’ option and reset your PIN after completing the required procedure. Alternatively, you can contact Easypaisa customer care support.

- Utilise Customer Service: In case of issues, reach out to Easypaisa’s customer service or visit your nearest franchise immediately, as this matter is about your finances.

Final Verdict

Setting up an Easypaisa account is quick, secure, and incredibly useful. Whether you’re a student, freelancer, business owner, or just someone who wants to manage money better, Easypaisa is a must-have.

Hope all the confusion on how to make an Easypaisa account is cleared now.

Frequently Asked Questions

Here are some commonly asked questions regarding making an Easypaisa account that will help with common problems that most beginners face.

Q- What Should I Do If I Forget My EasyPaisa PIN?

Ans: If you forget your login PIN, please immediately contact Easypaisa customer care support on their helpline and request a reset PIN for your account. This is the key to all your monetary funds in your account.

Q- Is It Safe to Use Easypaisa Without App?

Ans: Yes, it is completely safe to use Easypaisa without the app. If you still feel doubts then just download the mobile application.

Q- Can You Make More Mobile Accounts on Same Number?

Ans: You can only make one Easypaisa account on one mobile number at a time.

Q- Can You Change Your Easypaisa Account Name?

Ans: No, your account name is tied to your CNIC and cannot be changed.

Q- How Much Does Easypaisa Cost?

Ans: There are no charges for creating an Easypaisa account. You can sign-up for free.

Stay tuned to Brandsynario for the latest news and updates