Imagine you finally get your hands on the phone you’ve been wanting to buy for some time, but then it turns out that it becomes redundant in a few months, i.e., it can’t be used to make calls. How unfortunate will that be, right? This can happen if a person doesn’t pay the PTA tax on their phone.

There is a high chance you have already heard the term “PTA tax” around you.

“Bhai, yeh PTA approved haina?”

“Yar PTA approved wala lena, nhi toh double cost paregi,” said every Pakistani ever.

But ever wondered what this actually means? Why is it emphasised so much? And most importantly, how to check PTA tax to avoid getting your phone blocked?

How to Check PTA Tax Online

Checking your PTA tax isn’t as complicated as it may sound. In fact, all you need is your phone’s IMEI number, a stable internet connection, and a few minutes.

Step 1: Find Your IMEI Number

The first thing you need to check your PTA tax is your phone’s IMEI number (International Mobile Equipment Identity). This unique number helps identify your device.

Now, what is an IMEI number? Your phone’s IMEI number has a very important purpose, and here’s how to find it:

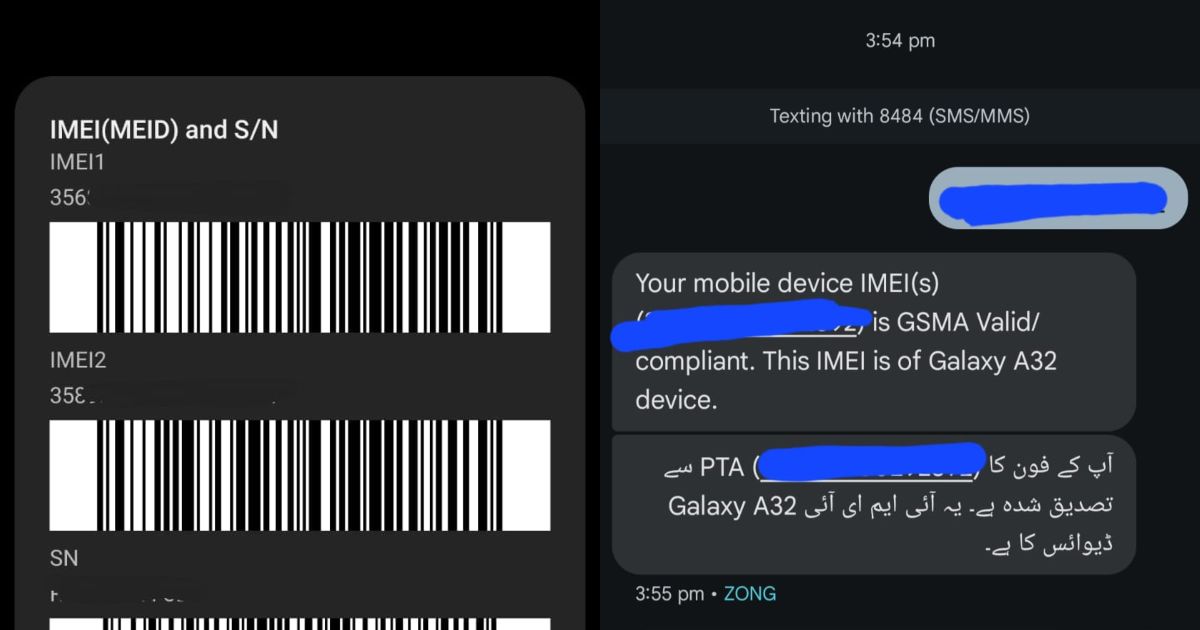

- Dial *#06# from your phone. This will display your 15-digit IMEI number.

- Or go to Settings > About Phone > Status > IMEI Information.

- If you’re using a dual-SIM phone, you’ll have two IMEI numbers; note down both.

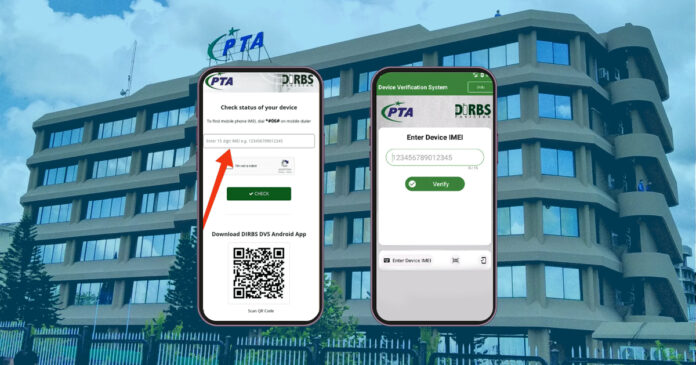

Step 2: Verify Your Phone

Now that you have your IMEI, it’s time to verify your phone’s status.

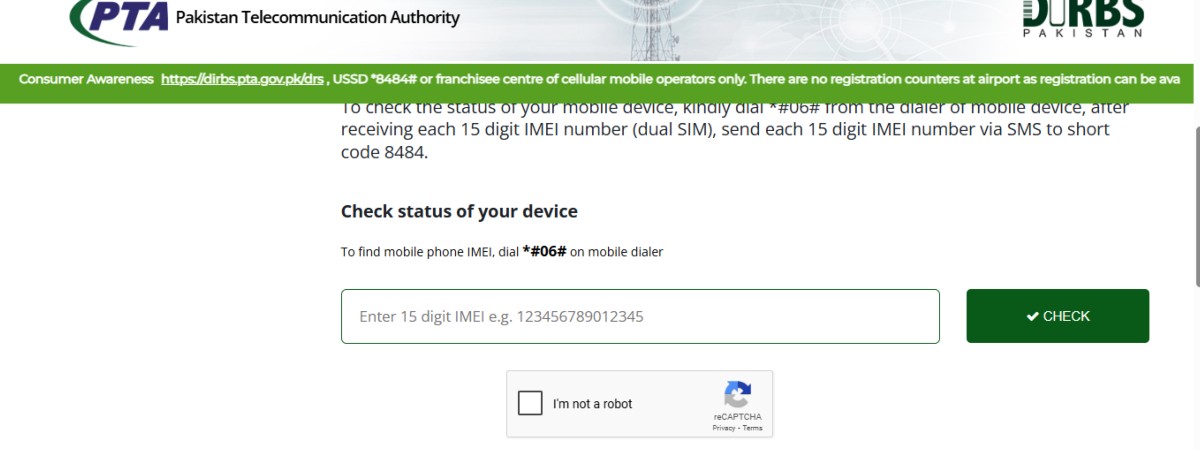

- Go to the DIRBS portal (Device Identification Registration and Blocking System) by PTA.

- Scroll and enter your IMEI number in the “check status of your device” option and then click “Check.”

- You’ll instantly know whether your device is PTA compliant or not. If your phone isn’t compliant, you’ll need to pay the PTA tax to avoid service disruption.

- International passengers and importers are requested to view this information to confirm the correct procedure for registration of mobile devices.

Step 3: PTA Tax Check Online

To check how much the PTA tax online, do these steps:

- Visit WeBOC’s Mobile Device Duty Information

- Enter your IMEI number in the designated box.

- Click Search to start the verification process.

- After verification, you will get any outstanding duties remaining for your device.

Pro Tip: You can also check your mobile PTA tax on the FBR’s Tax Asaan app

Registering Mobile Device for PTA Tax

Before proceeding, keep in mind that this method can only work in Pakistan and not in any other country. For the registration and payment process, one needs to be in Pakistan.

- Visit the official PTA website with this link: https://www.pta.gov.pk/

- On the website, select the online mobile registration option from the home page.

- This will open a login form, in which you will need to enter your email and password if you already have an account. Otherwise you will need to select the sign up option.

- Once the sign up option is selected, an account registration form will open with certain terms and conditions.

- Read this section properly as it can be very important in the process of payment. It includes information like: one mobile device per year can be registered for free, international travelers must register there mobile device within 60 days of their arrival etc.

- Below these terms and and conditions will be the registration form with two main options (purpose and user type).

- Fill in the whole form and double-check your CNIC/Passport details.

- After completing the form, an email verification will be sent to your provided email address

- Open the email and click the link mentioned in the email.

- After clicking, a login form will open. Enter the email and password to log in.

- After logging in, a declaration window will open with instructions. Ensure to read these instructions properly before clicking on click here to register your device option.

- Afterwards, click on the appropriate user type option, fill in your contact number and IMEI number (according to the number of SIM slots).

- Then click on submit, and a confirmation email will be sent that the mobile device has been registered.

How to Pay PTA Tax Online?

- Make an account on the Device Identification, Registration, and Blocking System (DIRBS) website.

- Apply for a Certificate of Compliance (COC).

- Enter your phone’s IMEI number(s).

- Pay the PTA tax online using mobile wallets, ATMs or bank branches.

What is PTA Tax?

Let’s rewind a bit. In Pakistan, the Pakistan Telecommunication Authority (PTA) charges a tax on all mobile phones brought into the country, whether they’re new or used. This tax is a customs duty you pay to legally use an imported or unregistered mobile phone in Pakistan.

It was introduced to prevent phone smuggling and ensure fair taxation. Paying for it ensures your phone works properly on Pakistani networks like Jazz, Zong, etc.

Simply put: if your phone hasn’t been imported through official channels, you’ll need to pay a tax to use it on local networks.

PTA tax depends on:

- Model: The newer and higher-end models have higher tax rates.

- Registration Type: Taxes differ for individuals registering devices via passports or on CNIC.

Why is the Mobile Tax Important?

While many people feel frustrated by this additional cost, it plays a major role in:

- Curbing illegal imports

- Protecting the local mobile market

- Increasing national revenue

- Fair taxation

- Balance between demand and supply

Think of it as a digital checkpoint to ensure every phone in the country is accounted for.

Why the Government Collects PTA Tax

PTA tax is not without a purpose, like it or not, but the government has legitimate reasons behind collecting such a tax. Here is why:

- Fairness: The PTA tax ensures that all citizens contribute their fair share to the country’s economic and social systems. By taxing mobile devices, the government encourages collective participation in funding national services and infrastructure.

- Market Control: Imposing PTA tax helps the government regulate the flood of imported devices and strikes a balance between demand and local supply. This control discourages unchecked imports and also supports local assemblers and manufacturers.

- Economic Growth: Revenue generated from the PTA tax is channelled into national development initiatives. These funds support critical infrastructure projects, technological advancements and long-term growth strategies, especially in the telecom sector.

- Network Support: The PTA tax provides essential funding to upgrade and sustain telecom infrastructure across the country. This ensures better connectivity, wider coverage, and improved service quality for users nationwide.

- Equity: The tax system is designed to distribute financial responsibility across different income brackets. Instead of placing the burden on a specific group, the PTA tax ensures a more equitable contribution from everyone.

How Much PTA Tax Will You Have to Pay?

As mentioned above, the PTA tax differs based on model and price of the phone, so it isn’t deterministic in nature. Usually, it’s somewhere between 17% to 32% of the phone’s declared value. You must ensure your device is PTA approved regardless of the tax percentage.

Here are the PTA tax rates based on the latest prices.

| Mobile Phone Price (USD) | PTA Tax (PKR) |

|---|---|

| Up to 30 | 1,230 |

| Above 30 and up to 100 | 6,400 |

| Above 100 and up to 200 | 17,280 |

| Above 200 and up to 350 | 23,800 + 17% GST |

| Above 350 and up to 500 | 34,000 + 17% GST |

| Above 500 and up to 700 | 52,000 + 17% GST |

| Above 700 | 60,000 + 17% GST |

Final Verdict

Whether you’re a frequent traveller, a mobile importer, or just someone who got a gift from abroad, knowing how to check PTA tax can save you from unexpected service blocks and hefty fines.

Yes, the process might feel tedious at first, but once you know the steps, it’s just a matter of a few clicks. So stay compliant and connected.

Stay tuned to Brandsynario for the latest news and updates.