Pakistanis have once again become a victim to a cyber attack, this time, the target was the country’s banking system. Bank Islami Cyber Attack occurred on 27th October as it fell prey to a breach compromising several accounts and reportedly, $6 million went missing.

State Bank of Pakistan (SBP) immediately took action by temporarily restricting the use of debit cards for those who are overseas, however, they can make transactions within the country.

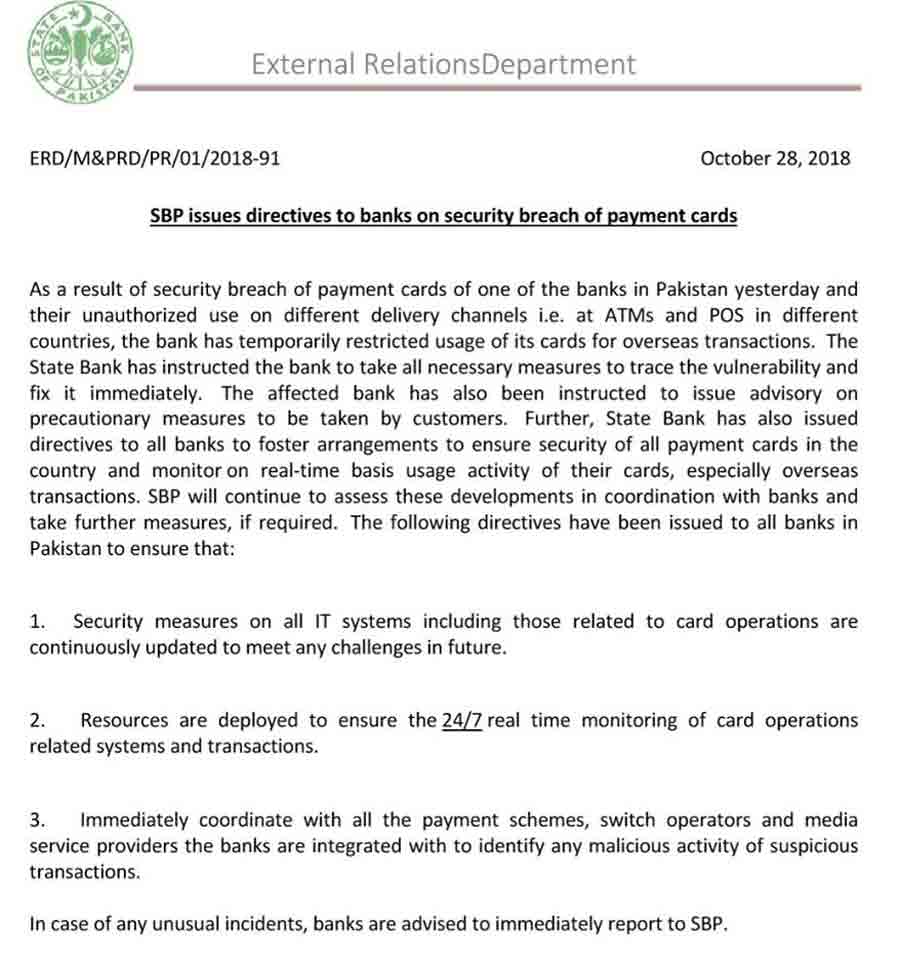

SBP issued a statement claiming;

As a result of a security breach of payment cards of one of the banks in Pakistan yesterday and their unauthorized use on different delivery channels ie at ATMs and POS (point of sale) in different countries, the bank has temporarily restricted usage of its cards for overseas transactions.

A Bank Islami account holder has confirmed that he received a message notifying him of his card usage at an ATM in Russia without consent.

A message notified me that somebody used my card somewhere in Russia, I immediately approached the bank’s helpline but the official simply did not believe my words and blamed me for the leak of particulars saying that I might have shared my bank account details with a friend or relative -Customer said to local publication

A senior banker dealing with cybersecurity confirmed the news while speaking to the local publication. He said:

That is true to the best of my knowledge – an unidentified group of hackers had broken into the data center of the said bank and stole the valuable data of the customers. This was unknown until the bank started receiving complaints from their customers regarding the theft.

BankIslami cyber attack is the third biggest cybercrime in Pakistan and second-largest to have hit the country’s banking system. Previously, Habib Bank and Careem also became victims to the security violations.

For security purposes, SBP has asked the bank to take the following precautions:

- Security measures on all IT systems including those related to card operations should be continuously updated to meet any challenges in future

- Resources are deployed to ensure the 24/7 real-time monitoring of card operations related systems and transactions

- Immediately coordinate with all the payment schemes switch operators and media service providers the banks are integrated with to identify any malicious activity of suspicious transactions.

BankIslami Responds to Cyber Attack

BankIslami also released an official statement on the matter:

On the morning of October 27, 2018, certain abnormal transactions were detected by BankIslami on our International Payment Scheme for Debit Cards.

Alhamdulillah, BankIslami team immediately took precautionary steps which included shutting its International Payment Scheme. All funds withdrawn from the accounts (i.e. Rs. 2.6 Million) of our valued customers have been reversed.

As a precautionary measure, all transactions routing through international payment scheme (Local and International POS, ATM and eCommerce) have been stopped.

However, we restored our Biometric ATM cash withdrawal service for our customers, the very same day.

Our technical teams are working in close coordination to restore other services.

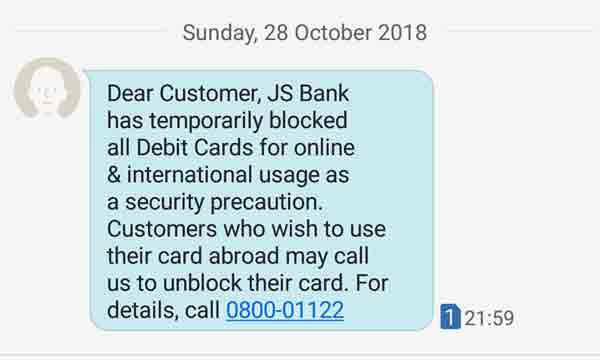

JS Bank Halts Debit Cards

On the other hand, JS Bank has also put a temporary halt to debit card transactions in the light of cybercrime attacks in Pakistan.

Social Media Reacts to BankIslami Cyber Attack

Many people took it to social media to express their sentiments over the issue.

Karachi:

Hackers Ka Bara Hamla, Mulk K Aik Islami Bank Se 80 Crore Rupay Chura Liye, 5 Hazar Cards Ghair Mehfoz, State Bank Ne Hidayat Jari Kar Di— Urdu News (@AbTk_Pak) October 29, 2018

It is BankIslami.

Thieves came to steal ‘Sawabs’ instead by mistake they stole Dollars..— Ahmed Javed (@aj_gatta) October 29, 2018

Hackers Ka Bara Hamla, Mulk K Ek Islami Bank Se 80 Crore Rupay Chura Liye, 5 Hazar Cards Ghair Mehfoz, State Bank Ne Hidayat Jari Kar Di

— All News 786 (@ALLNews786) October 29, 2018

Customers of #BankIslami in my list: Hope your money was intact #CyberAttack

— Ahsan Almani (@AhsanAAlmani) October 29, 2018

#BankIslami #FinancialCrimes #ITSecurity SBP needs to come down hard on Banks not complying with International Banking Security Standards. #Pakistan @fawadchaudhry @Asad_Umar https://t.co/wKL4G5x95g

— The Disillusioned Oracle (@PropitiousOn3) October 29, 2018

With emerging news of hackers attach on BankIslami Int. payments system, customer protection is essential.

In particular, terms &conditions should highlight how any losses from security breaches, systems failure or human error will be apportioned between bank and its customers.

— Hanif Vertejee (@Hanif98005542) October 29, 2018

Have you also become victim to the Bank Islami cyber attack? Or any other cyber attack?

Stay tuned to Brandsynario for more news and updates.