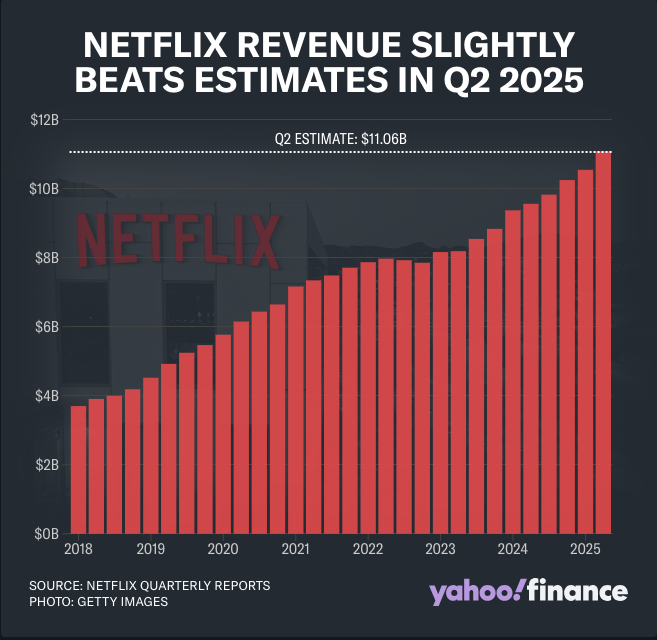

Netflix had a strong second quarter. It beat expectations on both revenue and earnings and raised its full-year forecast.

The streaming giant posted $11.08 billion in revenue, up 17.3% from last year and slightly above its $11.04 billion guidance. Earnings per share hit $7.19, higher than its $7.03 forecast and well above $4.88 a year ago.

Despite these strong numbers, Netflix’s stock slipped about 1% in after-hours trading. Investors are worried about its high valuation.

Netflix currently trades at 40 times forward earnings, which is much higher than the market average and most tech companies. Shares have already gained over 40% this year, so expectations were high.

Netflix remains optimistic. It expects third-quarter revenue to reach $11.53 billion, beating Wall Street’s $11.28 billion estimate. EPS should hit $6.87, above the $6.70 analysts predicted.

For the full year, the company raised its revenue outlook to between $44.8 billion and $45.2 billion. This is up from its earlier range of $43.5 billion to $44.5 billion.

“The majority of the increase in our revenue forecast reflects the recent depreciation of the US dollar vs. most other currencies, with the balance attributable to continued business momentum driven by solid member growth and ad sales,” Netflix said in its release. The dollar has dropped about 10% this year, boosting international revenue.

Ads are now a major growth driver. Netflix expects ad revenue to double to $3 billion in 2025. Its ad-supported plan costs $7.99 a month and has 94 million monthly active users, up from 70 million in November. Co-CEO Greg Peters said retention remains “stable and industry-leading,” and price hikes met expectations.

Netflix plans to spend more on content and marketing in the second half of the year. Hit shows like Wednesday, Stranger Things, and Squid Game will lead the lineup.

Sports and live events such as NFL Christmas games and WWE Raw could also attract more viewers. Netflix expects a 30% operating margin for the year, one point higher than previous guidance. It also confirmed it will not pursue large acquisitions.

Stay tuned to Brandsynario for latest news and updates