Most people often think that they have paid their taxes and their job is done. Well, they couldn’t be more wrong. Paying taxes is the bare minimum anyone can do. After filing your taxes, always verify your name on the Active Taxpayer’s List (ATL) from the Federal Board of Revenue (FBR) website.

For that, you need to have an NTN number. But what is an NTN, and more importantly, how to check your NTN number online without going through a confusing maze?

The complete form of NTN is the National Tax Number. In Pakistan, it is also commonly referred to as the Tax Registration Number. The FBR issues the NTN to taxpayers, and it is linked to their CNIC number, passport number, or business registration number.

Whether you’re a freelancer, business owner, or just a curious individual, you need to stay afloat for this one.

Check Your NTN Number – Easy Steps

Checking NTN number online might sound like something you’d need an accountant for, but the process is surprisingly simple if you know where to look.

1) Online NTN Verification by CNIC

The most common and hassle-free way to check your NTN number is by using your CNIC. This method is especially useful for salaried individuals or freelancers who may not have a registered business but still need a tax profile.

Here’s how you can do it in a few quick steps:

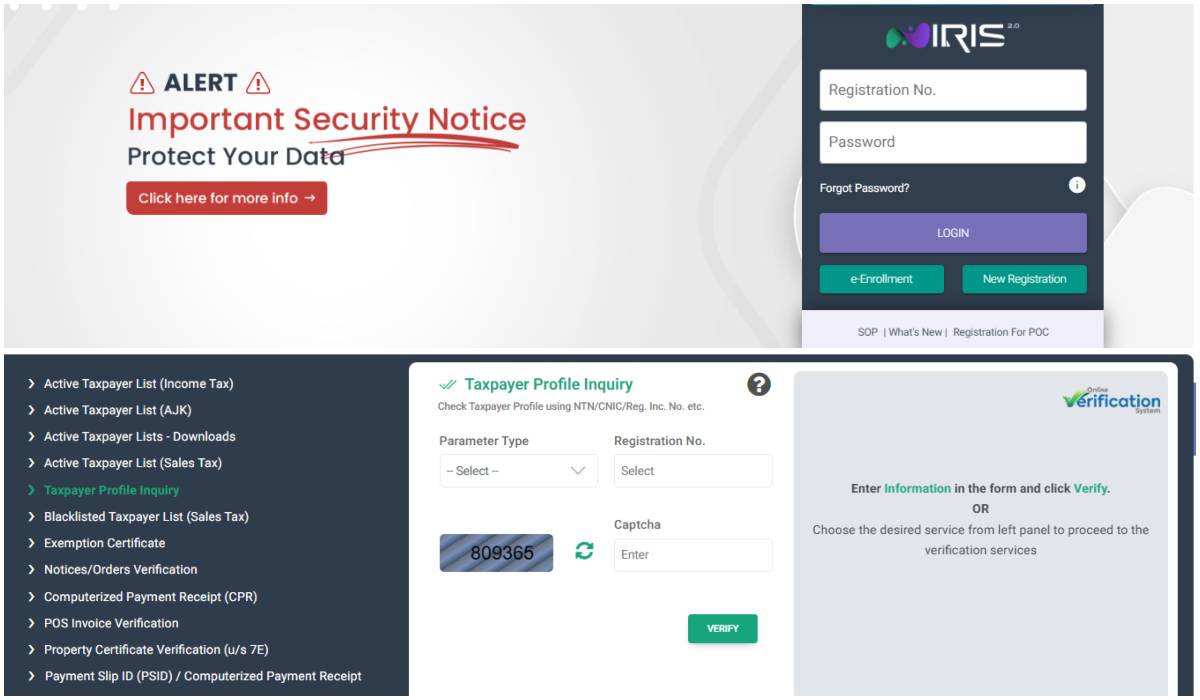

- Visit the FBR Online Verification page or IRIS 2.0.

- Scroll down the page until you see the Online Verification section.

- Click on the Taxpayer Profile Inquiry option in the left sidebar.

- From the Parameter Type drop-down menu, select CNIC.

- Enter your CNIC number in the designated field (without dashes).

- Complete the captcha to verify you are not a robot.

- After filling in all the required information and double-checking, click the Submit button.

Once the verification process is complete, the Taxpayer Profile Inquiry page will display your details, including your NTN listed as the Reference Number.

2) Taxpayer Profile Inquiry

Apart from just verifying your NTN, FBR’s portal also lets you check your Taxpayer Profile Inquiry. This gives you a broader picture of your tax status.

Here’s what you can typically find in your taxpayer profile:

- Registration Number

- Reference Number (this is your NTN)

- Email Address (will be displayed partially)

- Cell Number (will be displayed partially)

- Address Date of Registration Tax Office (Regional Tax Office or RTO)

- Any Business Registered on the Taxpayer CNIC

This is particularly useful if you’re applying for loans, tenders, or need to show proof of tax compliance.

3) More Methods to Find NTN Online

While the FBR IRIS portal is the primary method, there are a few other ways to find or confirm your NTN:

- Via Email Confirmation: When you register on IRIS, you receive a confirmation email with your NTN.

- Call FBR Helpline: Dial 051-111-772-772 for help if you’re unable to verify online.

- Using Your Income Tax Return Form: Your NTN is usually mentioned on the top right corner of your filed return.

- Through Different Parameter Type: You can also use your passport or registration/inc number as a parameter type in the same tax profile inquiry section to verify NTN.

If the FBR verification result shows ‘No Record Found,’ it means you are not yet registered with FBR or you are not an active tax filer. You will need to become a filer and apply for a free NTN (National Tax Number) online.

Obtaining an NTN Number

- Log onto the FBR Website: Open your browser and go to the Federal Board of Revenue’s official website.

- Sign Up or Create your Account: Create an account using your CNIC (Computerised National Identity Card) number.

- Apply for NTN: Fill out the online form and receive your NTN online, right away.

What is an NTN, and why is it Important?

NTN is a unique identification number that is allotted by the FBR. Without an NTN, you cannot file taxes, operate a registered business, or engage in certain financial operations. Think of it like your identity number in the tax world.

Having an NTN indicates that you are recognised by the government and compliant with tax regulations. This means you can rest easy without worrying about fines, penalties, or audits from tax authorities.

Additionally, possessing an NTN enhances your business credibility and provides you access to financial services such as bank loans and credit.

Importance of NTN Summarised

- Legitimacy: It makes your income tax compliant.

- Government Tenders: Many contracts require an active NTN.

- Loan Applications: Banks often request your NTN for creditworthiness.

- Import/Export: Required for customs and trade registrations.

- Filer Benefits: Active NTN holders get reduced tax rates on various transactions.

Issues During NTN Verification and How to Solve Them

While the process is mostly smooth, sometimes users run into problems when trying to check their NTN.

“No Record Found”

As mentioned above, too, “no record found” indicates that your CNIC is not registered with FBR.

Fix: Register on the IRIS Portal using your CNIC and mobile number as mentioned above.

“Inactive Taxpayer Status”

This means you haven’t filed your returns for the last tax year or your whole life (which is quite alarming)

Fix: Log into IRIS and become a filer to reactivate your status. You can also confirm your filer status to be sure.

Incorrect CNIC Format

Incorrect CNIC, NTN, or registration number entry is one of the most prevalent problems. Maybe you missed a number or used dashes.

Fix: Always type your CNIC as a 13-digit number without any formatting or dashes. Also, always recheck your information before checking.

System Down or Unresponsive

The FBR website occasionally goes down. Sometimes, hefty demand can cause the server to lag, particularly during tax filing season.

Fix: Try again after some time or contact the FBR helpline for immediate assistance. Also, clear your browser cache or try another browser like Google Chrome, Firefox, or Edge to see if it works.

Benefits of Having NTN in Pakistan

Still wondering if it’s worth the effort? Here are some real advantages of having an NTN in Pakistan:

- Lower Withholding Taxes: Filers pay less tax on banking transactions, vehicle registration, etc.

- Proof of Income: Useful for visa applications and financial audits.

- Business Growth: An NTN can improve your credibility and allow business expansion, particularly in business-to-business (B2B) and government tender situations.

- Access to Government Services: Many services now require tax compliance proof.

- Digital Economy Participation: Many freelance platforms require NTN registration.

Basically, it’s your gateway to being a financially empowered citizen.

Types of NTN in Pakistan

In Pakistan, there are three types of National Tax Numbers (NTN):

- Personal NTN: The FBR issues NTN based on the CNIC of an individual. It is available for both salaried individuals and self-employed persons. After registering for an NTN, taxpayers can also separately add a sole proprietorship to their FBR profile.

- Association of Persons (AOP) / Partnership NTN: This NTN is provided to groups of individuals engaged in a partnership. An AOP requires at least two partners. You can check the NTN for an AOP or partnership through the online NTN inquiry system.

- Company NTN: This NTN is issued specifically to registered companies. To verify a company’s NTN, you can use the FBR portal, entering the Incorporation/Company Registration Number provided by the Securities and Exchange Commission of Pakistan (SECP) at the time of the company’s registration.

Final Verdict

So, there you have it, a complete and easy-to-follow guide on how to check NTN number in Pakistan. It is a simple and easy process that requires some time on your behalf. Just keep your NTN number and CNIC number safe to avoid any inconvenience in the future.

And don’t wait until tax season panic kicks in. Take a few minutes today and check your NTN. Trust us and your future self will thank you.

Frequently Asked Questions (FAQs)

Here are some questions that many people often face regarding checking the NTN number online.

Q- What to Do if Your NTN is Not Found in the System?

Ans: If you are registered and also an active filer and still can’t find your NTN in the system then you need to reach out to FBR’s helpline at 051-111-772-772 for national and 0092 51 111 772 772 for international assistance. You can also email them at helpline@fbr.gov.pk.

You can also visit any Regional Tax Office (RTO) or Taxpayer Facilitation Centre (TFC) to inquire about your NTN status. But remember to take your CNIC, NTN registration receipt, and other relevant documents with you.

Q- Is the Reference Number the NTN Number?

Ans: Yes, the reference number is the NTN number (as we have also cleared above). Every Pakistani Tax payer has it as an identity.

Q- Where is the NTN Number Written?

Ans: NTN is written on the signboard. It is also written on all tax returns, payment challans, invoices and letter heads etc.

Stay tuned to Brandsynario for the latest news and updates.