Listen! Everything these days has gotten digitalised and you know what this means? Stricter check and balance and surveillance by the government. Gone are the days when people used to do tax evasion due to outdated systems.

Today, it’s the bare minimum to stay informed about your filer status with the FBR (Federal Board of Revenue). But how to check filer status, though?

How to Check Filer Status with Different Methods

Well, the FBR offers several convenient methods to check if you’re a registered filer with no jargon or confusion. Let’s walk you through each one of them.

Method # 01: Online Verification via FBR Website

This is probably the most direct and reliable way on how to check filer status online.

Here is how you can do it:

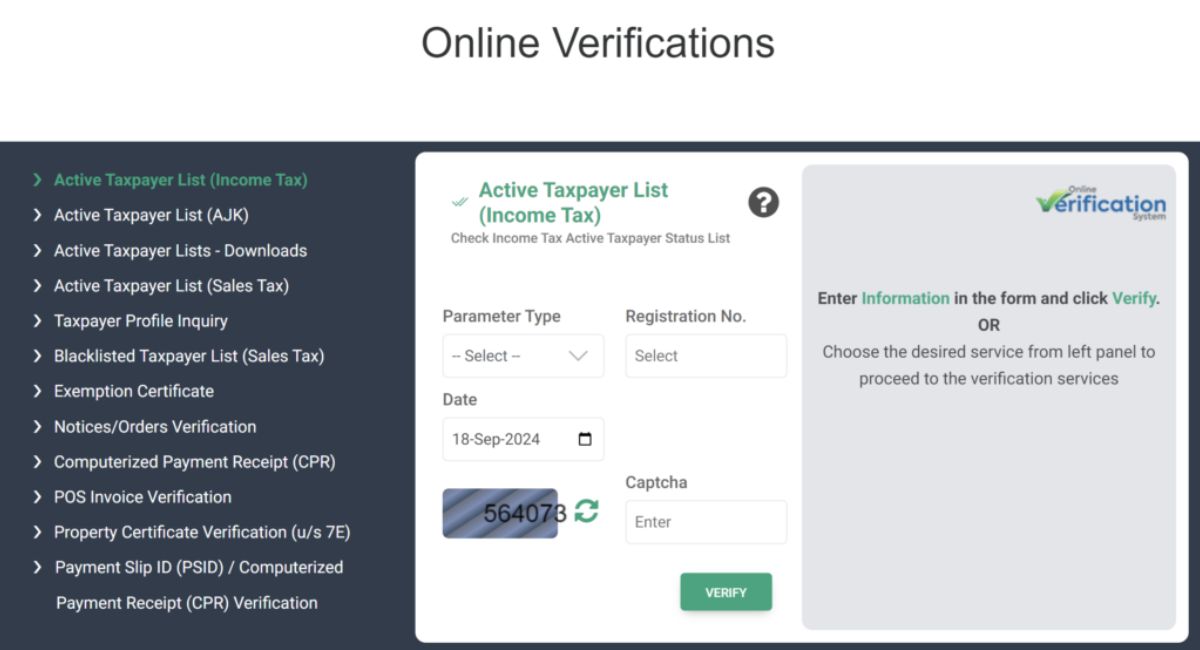

- Visit the New FBR IRIS website: Go to the new FBR IRIS website with this link: https://iris.fbr.gov.pk/#verifications. Even from the official website of FBR, you will be directed to this.

- Access the Online Verification Service: Scroll until you find the option “Online Verification Services“.

- Enter your information: Here, you will be required to fill in the following information:

- Computerised National Identity Card (CNIC) number (for individuals and locals), then enter the current date

- National Tax Number (NTN) (for businesses or Associations of Persons (AOP))

- Passport number (for non-residents)

- Select the appropriate parameter type: Choose the correct option for Parameter Type (NTN, CNIC, or Passport No.) from the dropdown menu. After this, enter the correct Captcha and click verify.

- Review the results: The system will display your filer status, showing whether you are an active taxpayer or not.

Method # 02: SMS Verification

Don’t have internet access or facing problems with the website? Well, there is an SMS verification method (it can’t be more convenient than this).

Here is what needs to be done:

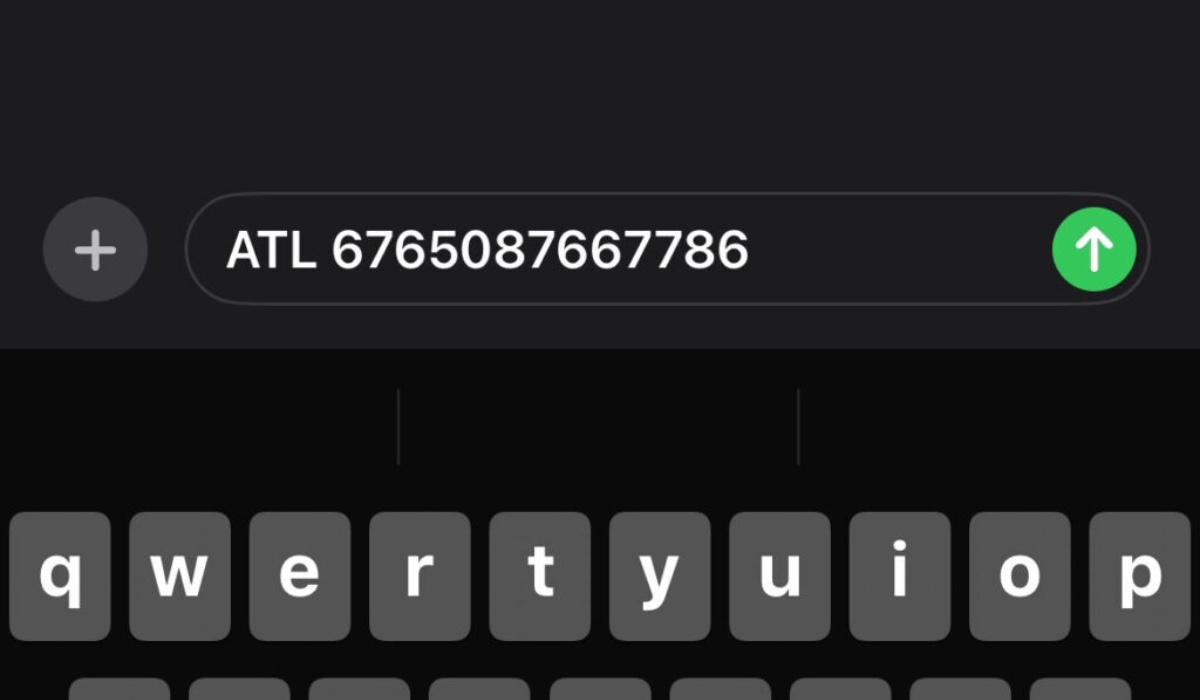

- Open your messaging app.

- Type: ATL <space> your 13 digit CNIC number (no dashes).

- Send it to 9966.

- You’ll get a reply with your current filer status.

See! It’s so fast and simple, and this one will work on any phone!

Method # 03: FBR Tax Asaan Mobile App

The Tax Asaan App is FBR’s official mobile app, designed for everything tax-related (including checking your filer status).

How to check via the app:

-

Download the Tax Asaan App (from the google play store and app store)

-

Open the app and tap on “Active Taxpayer List.”

-

Enter your CNIC, NTN, or Passport number to check your filer status.

Method # 04: Downloadable Excel List

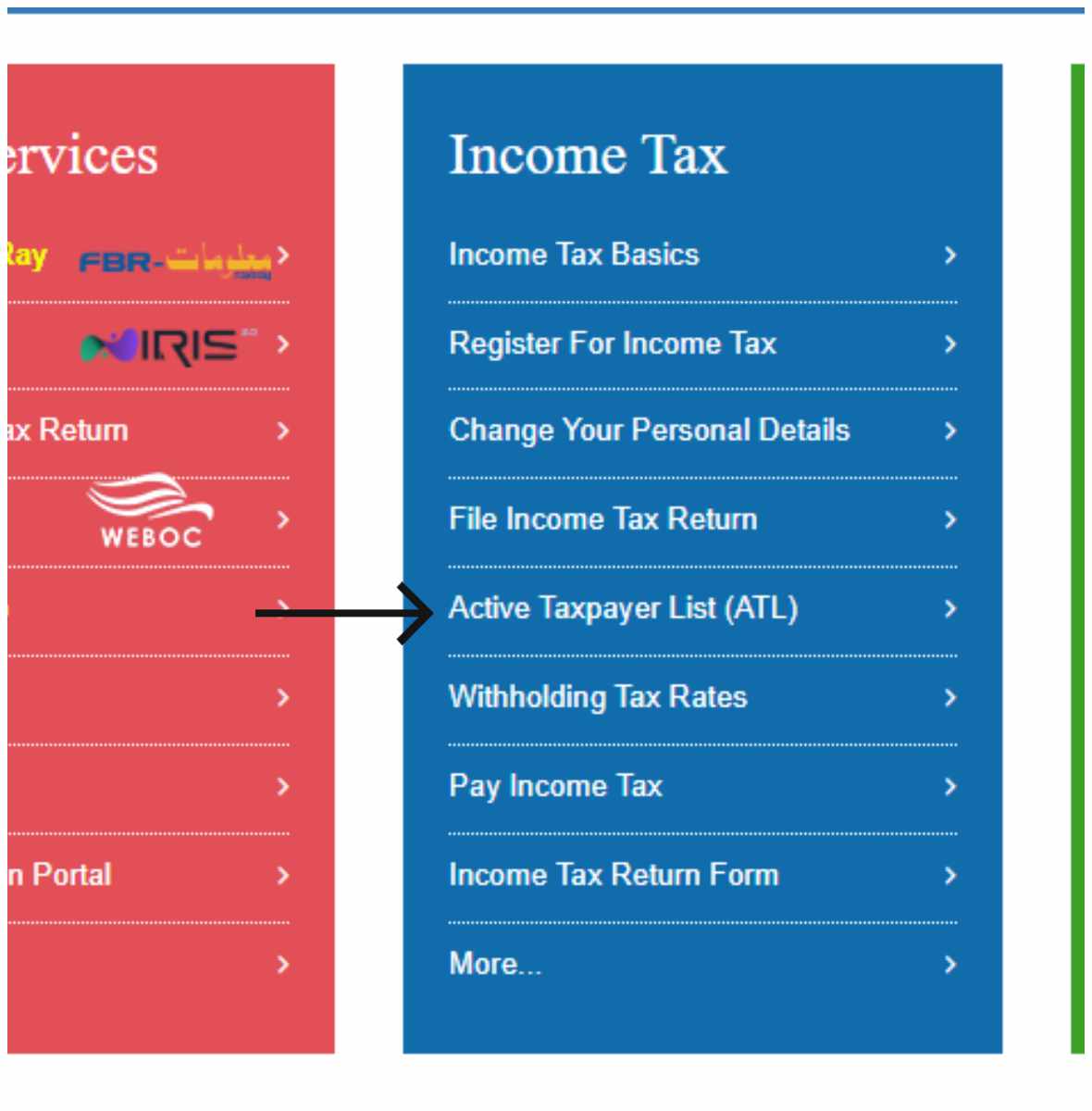

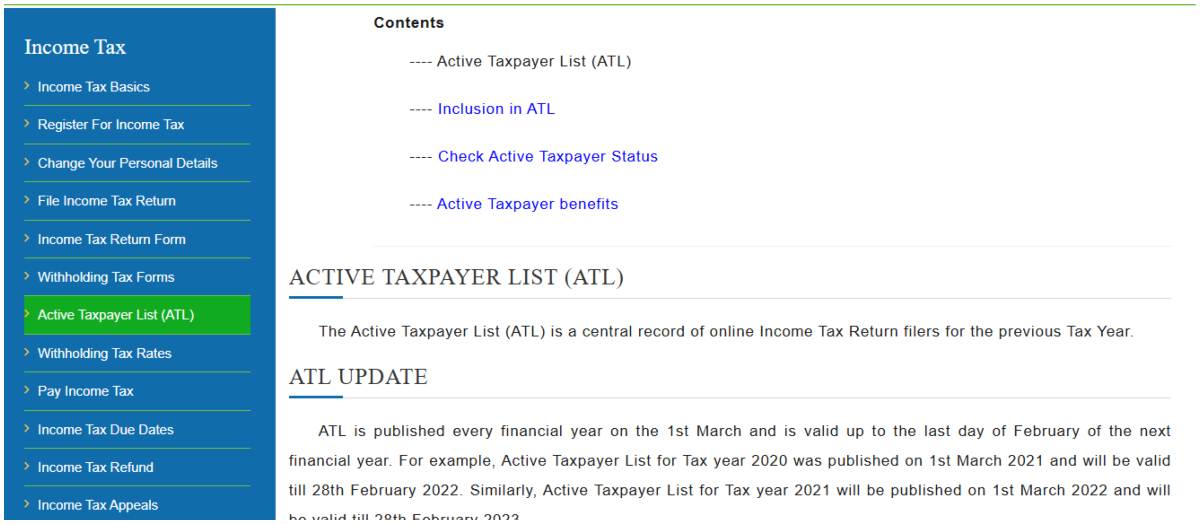

FBR also releases a downloadable Excel sheet (active taxpayer list) of all active taxpayers on their website. This list is updated every Monday and published annually on March 1st for the previous tax year.

How to use it:

- Visit FBR’s ATL section.

- Select on the “check active taxpayer status” option from the content section.

- From there, you will need to scroll until you reach the heading: “check active taxpayer status” by downloading ATL.

- This will have the downloadable excel file

- Download the file and then use the search function (Ctrl+F) to find your CNIC.

| Note: This method will not be the fastest as the website is a little confusing in the start but it’s still an option if you need offline access. |

Why is Filer Status Important?

I know that while people have normalised avoiding tax filing, it’s pretty difficult to stay true to your duty and stay informed. But it is all worth it! Here is why:

1. Lower Tax Rates For You

If you’re a filer, you’ll enjoy significantly lower tax rates on and you know what this means? More money share left for yourself. These include:

- Bank transactions

- Property purchases

- Vehicle registration

- Dividend income

- Cash withdrawals

2. Better Access to Financial Services

Filers can avail of various government incentives and schemes designed to benefit compliant taxpayers.

Planning to:

-

Apply for a loan or credit card?

-

Register a business?

-

Open a corporate bank account?

Most banks and financial institutions also prefer (or even require) you to be an active taxpayer.

3. Legal Compliance and Peace of Mind

Pakistan’s tax system is becoming increasingly digitised and integrated. That means the FBR is watching more closely than ever, and being a non-filer might raise a few eyebrows.

Advantages of being a filer:

-

You stay on the right side of the law, and there are fewer legal hurdles.

-

You avoid potential penalties or audits.

4. Participation in the Documented Economy

Being a filer also means you’re contributing to the country’s economic development. Every tax return filed helps build a better infrastructure, healthcare, education and public services.

Plus, it allows you to be eligible for government tenders, business licenses and other perks that only compliant citizens can enjoy.

Not on Active Taxpayer List (ATL)? What to Do

Well, there are two conditions for this situation. First one can be that you did file your taxes and there is just a technical error or the information is yet to be updated (I have elaborated on this below) so it’s not a big deal.

The other one can be that you didn’t file your taxes to start with and have a non-filer status.

For this, you will need to become a filer as urgently as you can. Otherwise, embrace yourself for the following issues:

- Higher tax rates.

- Restricted investment opportunities.

- Trouble registering vehicles or property.

Common Issues and their Solutions

Many people often get confused when they face certain problems. Here are the most common issues along with their solutions to make the process easier.

Incorrect CNIC Entry

Many people always get stuck in a stand still due to incorrect CNIC entry and they often don’t understand what they did wrong. CNIC is the most important in any tax related or legal compliance procedure so even the slightest of mistake will give you and error.

Solution

Enter your CNIC number correctly without any dashes, and before moving forward always re-check it thrice. This way you won’t be frustrated in the end.

Website Downtime

The FBR website might experience downtime during peak hours. This is very common and no you don’t need to get annoyed at it as any website can lag of get down when there is too much traffic on it.

Solution

Always try checking your status during off-peak hours; the time periods where you might think people aren’t necessarily using the website. Doesn’t work? Well just use the SMS option instead.

Outdated Information

Recently updated your tax return but it still shows outdated information or doesn’t show your CNIC on the Active Taxpayer List? Well it’s nothing to be panick about as things require some time to get updated, especially formal processing as everything needs to be accurate in it.

Solution

If you just filed your return, wait for 1-2 weeks for your name to appear in the ATL.

Final Verdict

Checking your filer status isn’t rocket science anymore. It just requires some time and diligence, that’s it. Hopefully, all the methods provided above helped you understand how to check filer status and now you will stay updated. For more information and updates, always refer to the official FBR website.

Frequently Asked Questions (FAQs)

Here are some questions that people often have regarding checking filer status.

Q- How Can I Check My NTN Registration Online?

Ans: Visit FBR Online Verification or IRIS 2.0. Scroll Down the page and you will see Online Verification. To find NTN number, click on the “Taxpayer Profile Inquiry” option from the left sidebar.

Q- How to Check CNIC Status?

- Open your mobile message app.

- Enter your application tracking ID and send it to 8400.

- You will receive a message from NADRA containing all the details regarding the status of your application for CNIC.

Q- What is Late Filer Status in FBR?

Ans: A taxpayer becomes a Late Filer if failed to file one of the last three tax returns by the due date or extended deadline.

Q- What is the NTN number?

Ans: The NTN or National Tax Number in Pakistan is a unique identification number assigned by the Federal Board of Revenue (FBR) to individuals, businesses and other entities.

This number serves as a means to track and monitor tax compliance, ensuring that taxpayers meet their obligations under Pakistan’s tax laws.

Q- How Do I Become a NTN Filer?

Ans: Once you have verified that you are eligible for Tax filing, you will have to gather all the important prerequisites. You will need:

- Computerised National Identity Cards (CNICs)

- National Tax Number (NTN)

- Proof of Income

- Bank Statements

- Proof of Tax Deductions and Credits

- Dependent Information

- Property & Asset Details

- Registered Phone Number

These documents will allow you to become an NTN filer in Pakistan.

Stay tuned to Brandsynario for the latest news and updates.